Kể từ tháng 7 năm ngoái, doanh số bán nhà tại Trung Quốc liên tục sụt giảm. Trong 7 tháng đầu năm, doanh số bán nhà tại quốc qua này chỉ đạt 900 tỷ nhân dân tệ (Khoảng 129 tỷ USD), thấp hơn 30% so với cùng kỳ năm trước đó.

Chuyên gia kinh tế cấp cao Gary Ng tại Natixis CIB (Asia Pacific) cho rằng nửa sau của năm 2022 Trung Quốc khó phục hồi nhanh chóng trong lĩnh vực bất động sản. Tình trạng đó sẽ tiếp tục gây ra trở ngại cho tăng trưởng kinh tế Trung Quốc.

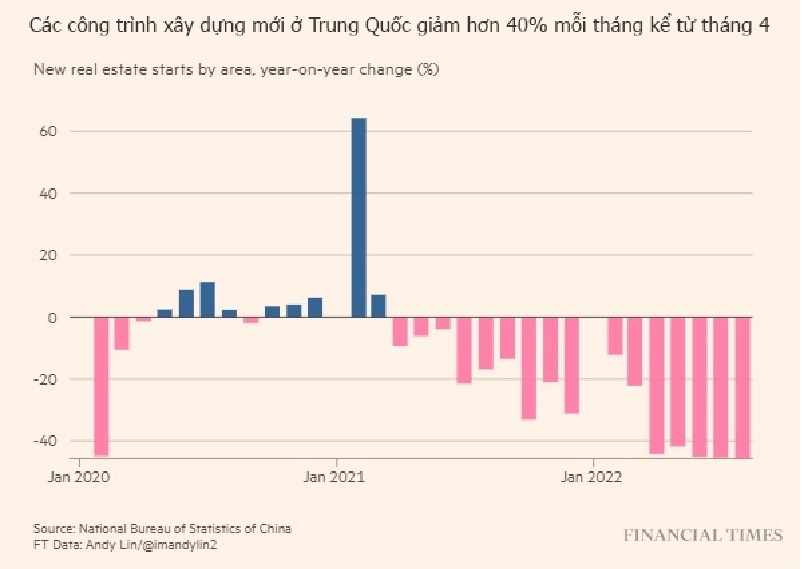

Sự sụt giảm về xi măng là dấu hiệu cho thấy tác động lan tỏa ngày càng tăng đối với các ngành công nghiệp khác được hưởng lợi từ sự bùng nổ xây dựng trước đó. Dữ liệu chính thức cho thấy các công trình xây dựng mới ở Trung Quốc đã giảm hơn 40% hàng năm mỗi tháng kể từ tháng 4.

Trong những năm gần đây, chúng tôi đã chứng kiến sự bùng nổ về xây dựng ở Trung Quốc. Các công ty xi măng kỳ vọng rằng họ sắp được kinh doanh xi măng cho các dự án cơ sở hạ tầng lớn này, ông Riley cho hay. Nhưng sau đó, sự kết hợp của cuộc khủng hoảng bất động sản và chính sách zero Covid của Trung Quốc đã thực sự giáng một đòn đau vào hoạt động kinh doanh.

Cổ phiếu của các nhà sản xuất xi măng lớn của Trung Quốc theo đó bị ảnh hưởng nghiêm trọng. Xi măng Conch An Huy và Xi măng Tài nguyên Trung Quốc, hai trong số những Công ty lớn nhất của đất nước, từng chứng kiến cổ phiếu niêm yết trên sàn Hồng Kông giảm lần thứ 3 từ đầu năm đến nay.

Các mặt hàng khác như quặng sắt - nguyên liệu sản xuất thép - cũng bị ảnh hưởng bởi sự yếu kém trong lĩnh vực bất động sản của Trung Quốc. Maike Metals International, một nhà nhập khẩu đồng tinh chế lớn, cho biết họ đang bán bớt tài sản để sống sót qua cuộc khủng hoảng thanh khoản do các vấn đề bất động sản gây ra.

Bắc Kinh đã phản ứng trong những tháng gần đây bằng cách công bố một loạt các hành động nhằm thúc đẩy nền kinh tế và lĩnh vực bất động sản, bao gồm cả các gói kích thích trị giá hàng chục tỷ USD.

Giá cổ phiếu của các công ty xi măng lớn nhất Trung Quốc liên tục lao dốc. (Nguồn: Bloomberg)

Với tình hình trong nước, ngành xi măng Việt Nam đang ở trong tình trạng dư thừa nguồn cung khi công suất sản xuất vượt quá nhu cầu thị trường nội địa và thiếu các nhà máy xi măng quy mô lớn. Những tháng gần đây, kênh xuất khẩu xi măng liên tục sụt giảm, tiêu thụ nội địa gần như dậm chân tại chỗ, trong khi chi phí sản xuất tăng quá cao, đe dọa lớn đến hoạt động của nhiều nhà máy xi măng.

Hiện giá nguyên liệu đầu vào cho sản xuất xi măng như than, giá cước vận tải tăng mạnh. Trong khi đó, tiêu thụ mặt hàng này chậm lại, tồn kho lớn khiến các doanh nghiệp sản xuất xi măng đứng trước áp lực cạnh tranh gay gắt về giá.

Theo Hiệp hội Xi măng Việt Nam, hàng tồn kho đang là nỗi lo lớn của không ít doanh nghiệp xi măng hiện nay và là thách thức lớn đối với ngành trong những tháng cuối năm 2022.

Dự báo, từ nay đến hết năm, xuất khẩu xi măng tiếp tục sụt giảm. Theo đó, sự suy giảm trên kênh xuất khẩu có thể làm gia tăng áp lực cạnh tranh trên thị trường nội địa. Trung Quốc, Philippines là 2 thị trường nhập khẩu chính của xi măng, clinker đã giảm nhập khẩu từ Việt Nam kéo theo sự suy giảm mạnh mẽ trong những tháng qua.

(Nguồn: ximang.vn)