Giá dầu biến động mạnh

Cuối tháng 2 đã xảy ra cuộc chiến tranh giữa Nga - Ukraine. Từ đó đến nay cuộc chiến vẫn diễn biến phức tạp tiếp tục gây ảnh hưởng đến kinh tế toàn cầu. Cuộc chiến đã gây ra các vấn đề lớn như khủng hoảng năng lượng, khủng hoảng lương thực, giao thương toàn cầu, logistic. Cuộc chiến cũng gây ra cơn bão lạm phát toàn cầu tại các trung tâm kinh tế lớn trên toàn Thế giới. Nga là nước sản xuất dầu lớn thứ hai Thế giới và chủ yếu bán dầu thô cho các công ty lọc dầu châu Âu.

Sau khi tăng hơn 50% trong năm 2021, mặc dù được dự đoán sẽ tiếp tục đi lên trong năm 2022, nhưng giá dầu Thế giới vẫn khiến các nhà đầu tư đi hết từ ngạc nhiên này tới bất ngờ khác khi liên tục xác lập “đỉnh” mới.

Tới tháng 6 năm 2022, giá dầu bắt đầu có những đợt điều chỉnh giảm đáng kể, tuy nhiên chưa thật sự ổn định vẫn khiến các nhà đầu tư lo ngại.

Giá than tăng kỷ lục

Cuối năm 2021, nhu cầu tiêu thụ than của nền kinh tế thế giới tăng dần; đặc biệt từ tháng 3/2022, căng thẳng Nga - Ukraine bùng phát dẫn đến nguồn cung than không đủ đáp ứng nhu cầu. Giá than liên tục tăng đạt các mốc kỷ lục và đến thời điểm hiện nay giá Thế giới đã tăng gấp từ 2,5 - 3 lần kể thời điểm từ đầu năm 2022.

Philipines áp thuế chống bán phá giá với xi măng nhập khẩu từ Việt Nam

Cục Phòng vệ thương mại (Bộ Công Thương) cho biết, ngày 11/3, Ủy ban Thuế quan Philippines thông báo kế hoạch triển khai tiếp theo trong vụ việc xem xét gia hạn biện pháp tự vệ đối với mặt hàng xi măng loại 1 và loại 1P nhập khẩu từ một số nước, trong đó có Việt Nam.

Việc ban hành dự thảo kết luận điều tra và thông báo về việc tổ chức Phiên điều trần công khai dự kiến diễn ra ngày 25/3/2022. Tổ chức Phiên điều trần công khai dự kiến diễn ra ngày 1/4/2022 và từ ngày 4 - 7/4/2022. Đến tháng 4/2022 ban hành kết luận cuối cùng của Ủy ban Thuế quan.

Trước đó, sau quá trình điều tra Bộ Thương mại và Công nghiệp Philippines (DTI) kết luận lượng nhập khẩu xi măng đã gia tăng đột biến, là nguyên nhân gây ra thiệt hại nghiêm trọng cho ngành sản xuất trong nước trong thời kỳ điều tra.

Nhằm bảo vệ ngành sản xuất nội địa cũng như thúc đẩy ngành sản xuất nội địa tiếp tục phát triển, từ năm 2019, Bộ Thương mại và Công nghiệp Philippines đã quyết định áp dụng sắc thuế tự vệ tạm thời 8,40Php/túi 40kg, tương đương khoảng 4 USD/tấn đối với xi măng Việt Nam xuất khẩu vào thị trường này.

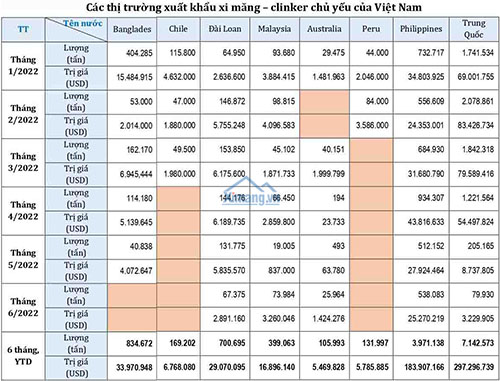

Các thị trường xuất khẩu chính giảm sản lượng và áp thuế tự vệ

Thị trường xuất khẩu lớn nhất của ngành xi măng Việt Nam là Trung Quốc, đã gặp khó khăn trong 6 tháng đầu năm 2022. Trung Quốc đang siết dần thị trường bất động sản với chính sách “3 lằn ranh đỏ” làm hạn chế khả năng vay nợ và đảo nợ của các nhà phát triển bất động sản. Do đó nhu cầu nhập khẩu xi măng từ thị trường Trung Quốc sẽ giảm.

Xi măng xuất khẩu sang thị trường Philipines chịu thêm thuế tự vệ của nước sở tại. Philipines (áp thuế nhập khẩu khoảng 5% giá bán), Bangladesh (áp thêm 8% GTGT từ mức 15% lên 23%). Điều này có thể tạo ra xu hướng áp thuế tại nhiều thị trường xuất khẩu khác của Việt Nam như Trung Quốc, châu Phi.

Trung Quốc điều chỉnh mục tiêu sản xuất xi măng

Việc sản xuất xi măng sử dụng nhiều than, phát thải carbon và thải ra rất nhiều bụi gây tác động xấu đến môi trường. Trong khi đó, Trung Quốc đang hướng tới cắt giảm carbon trong kế hoạch 5 năm của mình. Đồng thời, quý I năm 2022 là thời điểm thế vận hội mùa đông 2022 tại Bắc Kinh diễn ra sẽ giúp cắt giảm sản lượng sản xuất các nhà máy xi măng hơn nữa.

Trung Quốc tiếp tục duy trì chính sách “Zero Covid” để kiểm soát dịch Covid-19, thực hiện phong toả các cảng biển… đã tác động đến giao thương của nhiều quốc gia, trong đó có Việt Nam. Bên cạnh đó, nền kinh tế Trung Quốc ở giai đoạn suy thoái với hàng loạt các vấn đề như: dư âm cuộc chiến thương mại Mỹ - Trung, khủng hoảng khu vực bất động sản, giảm đầu tư công.

Bên cạnh đó, Trung Quốc nhập than rẻ từ Nga và có dấu hiệu phục hồi lại một số ngành công nghiệp nặng như sắt thép, xi măng. Giảm nhập khẩu tối đa từ nước ngoài.

Xi măng Trung Quốc với áp lực “xanh hóa” và “giảm giá”

Theo Sunsirs, giá xi măng giao ngay tại Trung Quốc ngày 19/5 là 472 nhân dân tệ/tấn (70 USD/tấn), giảm 1,7% so với ngày trước đó, tiếp đà giảm từ tuần trước. Từ đầu tháng 5, giá mặt hàng này giảm 7%.

Thêm vào đó, ngành Xi măng đang phải đối mặt với việc "xanh" hóa, giảm khí thải ra môi trường. Xi măng vốn là ngành cần nhiều năng lượng và sử dụng than nhiều. Cụ thể, sản xuất một tấn xi măng cần 200 - 450 kg than và phát thải ra ít nhất 600 kg carbon.

Do đó, xi măng có lượng khí thải carbon khổng lồ chiếm khoảng 8% lượng khí thải toàn cầu, cao gấp đôi so với lượng khí thải từ ngành hàng không hoặc vận chuyển đường biển trong khi Trung Quốc sản xuất gần 60% lượng xi măng trên Thế giới. Năm 2020, ngành ở Trung Quốc thải ra khoảng 1,23 tỷ tấn carbon, chiếm 14% con số của cả quốc gia này.

EU ủng hộ kế hoạch áp thuế phát thải CO2 đối với hàng hóa nhập khẩu, trong đó có xi măng

Các quốc gia Liên minh châu Âu (EU) ủng hộ kế hoạch áp thuế phát thải CO2 đối với hàng hóa nhập khẩu gây ô nhiễm - một hình thức đánh thuế carbon xuyên biên giới.

Theo kế hoạch, từ năm 2026, EU sẽ áp thuế phát thải khí CO2 đối với các mặt hàng nhập khẩu gây ô nhiễm, ví dụ như thép, xi măng, phân bón, nhôm và điện. Công nghệ hiện đã cho phép xác định chính xác, sản xuất ra một sản phẩm sẽ thải ra bao nhiêu lượng CO2. Các sản phẩm nhập khẩu sẽ phải mua giấy phép ô nhiễm từ hệ thống thương mại khí thải của EU căn cứ vào lượng khí thải carbon trong quá trình sản xuất.

Chính sách xuyên biên giới sẽ tạo sân chơi bình đẳng khi áp cùng mức thuế phát thải CO2 đối với các Công ty trong và ngoài EU. Việc châu Âu áp thuế carbon sẽ thúc đẩy doanh nghiệp nước ngoài phải chủ động cải tiến quy trình sản xuất nhằm giảm lượng khí thải. Cơ chế thuế phát thải sẽ là một nguồn thu mới cho ngân sách châu Âu, ước tính từ 5 - 14 tỷ Euro/năm.

(Theo ximang.vn)